Users can install official Cash App and PayPal applications from Google Play Store and App Store for free in all Androids and iOS. Let us discuss the main differences between Cash App and PayPal.

Major Differences

Cash App and PayPal are two money transaction applications that are widely used all over the world. Cash App is an Instant-transferable application that allows users to send and receive money quickly. On the other hand, PayPal is also a transferring cash app but is more convenient than Cash App.

What is Cash App?

Cash App is a cash transfer platform for sending and receiving money. This platform is the best for the users because it is an online transferring platform that makes your world reliable. Cash App is a trustworthy website, and users are satisfied with its use. Moreover, it also allows you to invest your money here and get profit. Users can exchange their cash in Bitcoin.

Furthermore, the Cash App is free of cost to transfer and receive money. You can install its official Cash App website from the App Store and Google Play Store. Its limitation is very low as users can send only $1000 monthly. Cash App service is available all over the U.S. and in the UK. It does not work internationally. In addition, it is working more to offer its services in more countries.

Features

- No transaction fee

- Refers cash card

- Investment services

- Easy to use

- Easy to access

- Cash back service

What is PayPal?

PayPal is an instant money transaction application for one place to another place internationally. It is effortless to transfer money with the help of PayPal. Moreover, it keeps users’ information encrypted. It is highly secure to transfer money from PayPal. Furthermore, it does not require users’ personal information and keeps their data safe.

In addition, PayPal is the more convenient platform for transactions. You can transfer and receive money, pay online, and buy accessories from marketplaces. In PayPal, users can transfer a maximum of $9000-$10000 monthly. In addition, it is an electronic system that transfers money from one account to another account or from one country to another country.

Features

- Transfer money internationally

- It is more convenient than other

- To much faster service

- Easy to use and transfer

- Secure and encrypted

- It does not require any personal information

- Easy to create an account

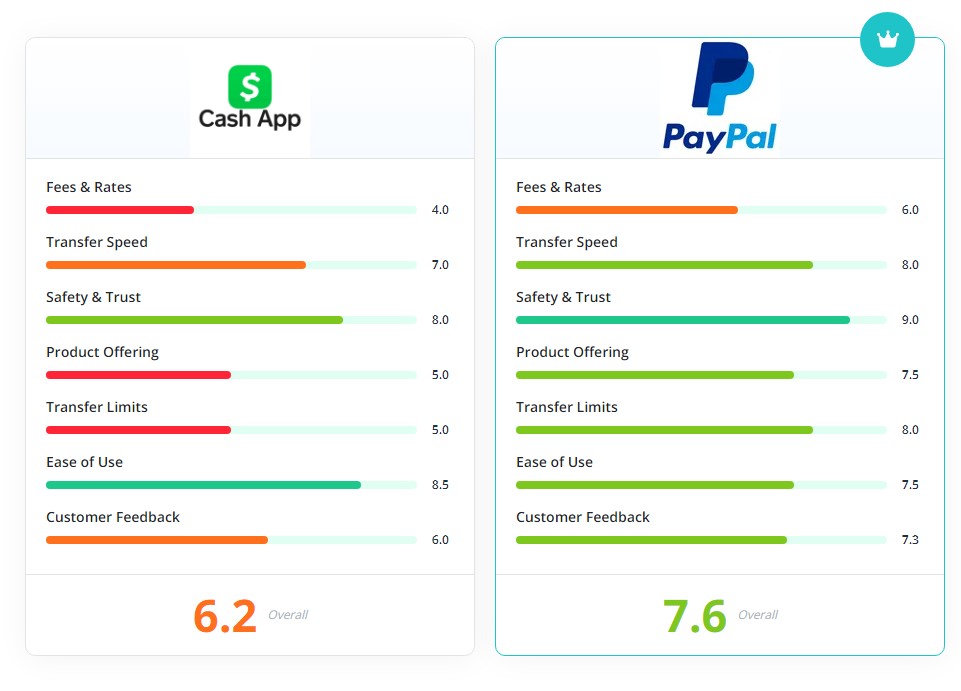

Key Differences between Cash App and PayPal

- Cash App is a money transaction application. On the other hand, PayPal is an electronic transaction system.

- The maximum limit to transfer money is $5000-$7000 from Cash App, while $9000-$10000 is the ultimate limit of PayPal.

- Cash App transfers money domestically, whereas PayPal transfers domestically or instantly.

- PayPal is more secure than Cash App.

- PayPal offers more services than Cash App. The number of customers is 430 million PayPal while 70 million customers use Cash App.

Comparison table between Cash App and PayPal

| Features | Cash App | PayPal |

| Nature | Transaction application | Electronic system |

| Transaction limit | $5000-$7000 | $9000-$10000 |

| Transaction fee | No require | Require |

| Crypto assessments | Yes | No |

Conclusion

In a nutshell, we can say that Cash App and PayPal differ. They are serving with their unique features and services.